One-time investment. Lifetime support. Your complete roadmap to fundability.

You’re not getting rejected because your business doesn’t deserve funding. You’re getting rejected because you don’t know what lenders actually need to see, and nobody’s telling you.

Banks want specific credit thresholds but they won’t tell you which accounts you need to fix first. We show you exactly what’s dragging your profile down.

SBA programs have lender specific requirements that vary widely and most people apply blind.

Your debt ratios might be killing deals before they even start and you would never know it.

This isn’t a generic credit report or business template. This is a comprehensive analysis of your entire business, your financials, and your exact path to loan approval, created by the only lending company in America with a real-time SBA eligibility checker.

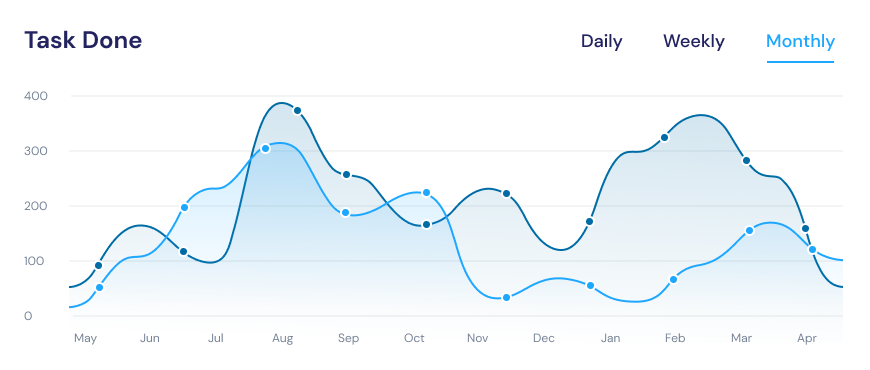

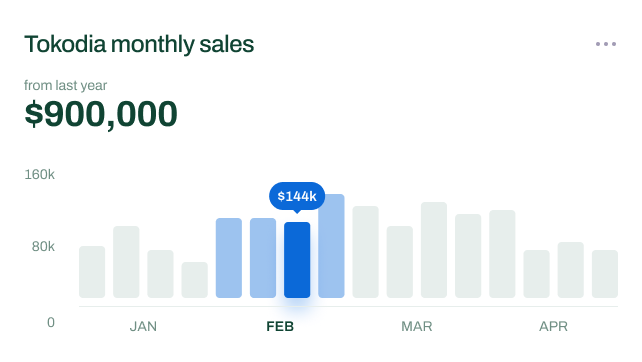

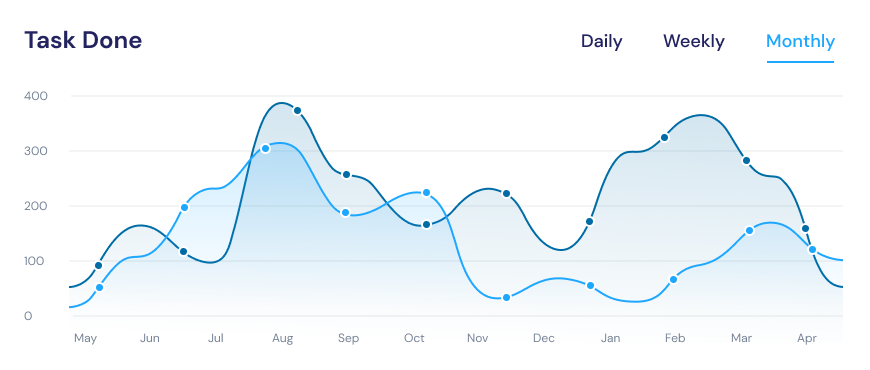

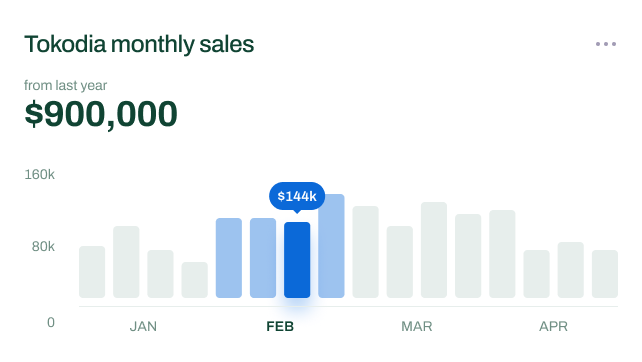

Track performance

Boost your business

“Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod

Get a clear, lender-ready analysis of your business so you know exactly what to fix, what to improve, and how to get approved faster.

What lenders need to see from businesses with limited history, how to prove stability faster, and your timeline to eligibility with different lender types.

No vague advice. We tell you which accounts to pay down first, by how much, and in what order so your fundability score increases as fast as possible.

Get a clear, lender-ready analysis of your business so you know exactly what to fix, what to improve, and how to get approved faster.

Know exactly where you stand with different SBA loan programs and what needs to change for approval with each one.

We identify problematic debt ratios and show you how to restructure for better lending terms and improved approval odds.

A step-by-step timeline showing what to do each month to improve your fundability. No more guessing. Just a clear path forward.

Everything you need to prepare for future approval, so the moment you hit fundable status, you’re ready to move immediately.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Start free, no credit card needed

Start free, no credit card needed

Customize your dashboard to match your workflow.

Customize.

17h

Customize.

17h

Customize.

17h

Monitor progress, optimize performance, and scale easily.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

/ Month

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

/ Month

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

/ Month

From Rejected to Approved in 3 Simple Steps.

Purchase your personalized analysis. We’ll analyze your application, credit profile, business financials, and industry benchmarks.

Implement the exact steps we outline in your 90-day action plan. Know exactly what to fix, when to fix it, and how to document it.

From Rejected to Approved in 3 Simple Steps.

Purchase your personalized analysis. We’ll analyze your application, credit profile, business financials, and industry benchmarks.

Implement the exact steps we outline in your 90-day action plan. Know exactly what to fix, when to fix it, and how to document it.

Once you’ve built what lenders need to see, you’ll be first in line for our bank-backed SBA

We turn your financials into a clear, actionable path to real bank-backed funding.

"I fell victim to a shark loan that was well on track to putting me out of business. Thanks to Integrity Cap's team, I was able to save my business. I cannot thank them enough!"

"After being turned down by three other banks, Integrity Cap was truly our last hope. The entire SBA loan approval process took only one month. We are forever grateful!"

"From the first day I contacted Integrity Cap to the day I was funded was less than 3 weeks. Because of them, my company is on track for amazing growth in 2025."

Once you purchase, we will deliver your comprehensive report within 3 to 5 business days. We can usually deliver these sooner, however some of the third party reports that determine your eligibility take days to be returned from the providers.

Absolutely. This is not a template. We analyze your application, credit profile, financials, and industry to create a report specific to you, including offers that are unique to your business.

It depends on your starting point and how quickly you implement our recommendations. You may qualify already based upon the report! Some businesses see improvement in a week, others take 3 to 6 months. Without a clear roadmap, you could spend years trying random tactics. We remove the guesswork and provide a path to bankability.

Yes. Once you have built what lenders need to see, you will be first in line for our bank-backed financing network. You will already have a relationship with us, so you will not need to start from scratch.

Yes. One payment gives you your complete consultative report, offers (if applicable), 90 day action plan, SBA prep package, and lifetime support.

We are not a credit repair company. We are a full suite lending eligibility company. We do not just want to fix your credit; we want to help your business become bankable. This report is our investment in making that happen, based upon thousands of approved businesses just like yours.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

"Our expenses dropped by $23,000 a month, and now we have the funds to grow! I couldn't have done this without you. Thanks Integrity Cap!"